Stock Market Put Options and September 21, 2007

Monday, September 17th, 2007Put options of the stock market can be looked at as bets that stock will crash. Put options on United Airlines and American Airlines were placed by an anonymous investor shortly before 9/11. United and American Airlines are the companies whose aircrafts were hijacked during 9/11 attack. Because put options involve great risks, if someone puts billions of dollars in put options, it clearly indicates that they know something we don’t know. Put options that were place prior to 9/11 were later traced by private researchers (Securities and Exchange Commission refused to reveal this information) to a Dutch bank with ties to a former CIA director.

In late August this year (few weeks ago) somebody again placed 245 000 put options anonymously on the Dow Jones Eurostoxx 50 index which would once again indicate that someone has a foreknowledge that the general public does not.

These anonymous investors are basically risking $1 Billion dollars that we’re going to have another event similar to 9/11 by September 21st, or they’ll lose their money. The only way for them to make money out of that huge investment is if the market crashes by a third to a half by September 21st 2007 (that is the expiry day of said put options).

Sales of this scale are referred to as “Bin Laden Trades” because it would take another 9/11 (or a Chinese dollar reserve dump) to make these options valuable. If such event does occur, the trader is looking at cashing 2 billion dollars.

Now – why is it that someone knew exactly what was going to happen on 9/11 and was able to cash on put options big time? How come they knew exactly which airlines will be hijacked and when?

Not surprisingly, the 9/11 commission released the statement after their investigation, that even though some unusual trading activity did occur just before 9/11, quote “it was all coincidentally innocuous and not the result of insider trading by parties with foreknowledge of the 9/11 attacks”

Here’s a comforting news (though coming from an independent investigator, not a verifiable source):

Most of the investments in these put options originated in Germany through the Deutsche Bank. Deutshce Bank had earlier acquired Banker’s Trust, an investment banking firm whose Vice Chairman in charge of “private client relations” in the late 1990’s was A. B. “Buzzy” Krongard. In March of 2001, Krongard was appointed Executive Director of the CIA.

On the other hand – billions of dollars change hands in trades every day. Pro Investors with giant fund managers follow their indicators and make investments based on it. Billion dollars is not uncommon in these circles. Sometimes they make a whoop lot of money because they’ve made an educated guess. Other times they lose but it has been proven throughout the history that this kind of co-incidental trades do happen.

Today, there’s 4 days left to see if it’s all just a big conspiracy theory or something we should have really listened to…

Most People Reading This Article Found It Searching For:

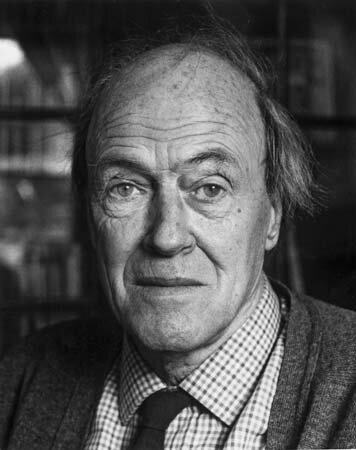

- a pitcher of Roald dahl

- roald dahl illustrations

- roald dalh

- pitchers of roald dahl

- oj simpson fahndungsfoto

- OJ Simpson stock photos